Previous Article

Financial Software Company — Data Science and Agile Build

Summary

A financial software company wanted to launch a new lending business that could lead to a new source of revenue.

Silicon Valley Data Science applied agile data science methods to target customers based on need and likelihood of approval.

Background and Business Problem

The accounting products division of a financial software company wanted to launch a new business in small business lending, targeting customers currently using their products. Our client needed both a holistic integrated solution to address their strategic goals and to quickly build out, and demonstrate the business value derived from data-driven analytical capabilities to meet their launch date.

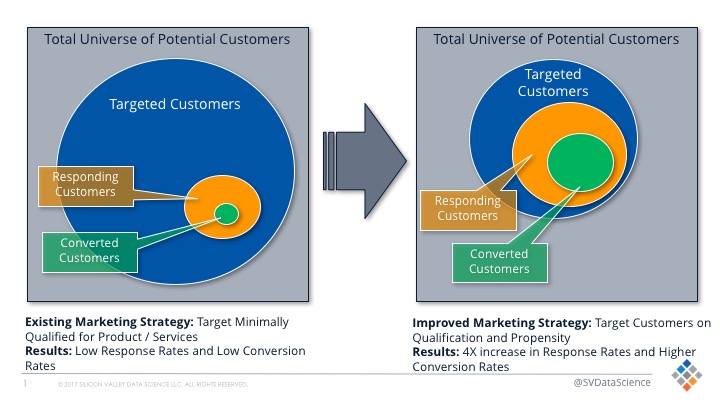

The accounting division already had a referral lending business that generated $350m in outstanding loans over three years. Loans were marketed to customers via 500,000 direct mails per month using basic loan criteria to target small businesses, such as number of employees, minimum number of years in business, location, and industry codes. Conversion rates were believed to be low due to a combination of insufficient targeting and high drop-off/low approval rates.

Our client wanted to tap into the profit pools available in small business lending by seizing the opportunity available today, as established lenders are cautious to expand their balance sheets. They were uniquely positioned because they could leverage proprietary accounting, finance, payroll, and payments data from their customer base, and because their suite of software products provides a highly targeted channel of customer acquisition via in-app marketing.

Solution

SVDS created a streamlined monthly marketing campaign process that targeted customers based on need. Our team helped develop a true picture of the customer universe and a clear understanding of the customers who would most likely need a loan, yielding a 4x improvement in the referral lending business over the original process.

Additionally, we identified internal complexities in bringing a new data product to market, including the onboarding of datasets that enable analysis and insight into the customer profile along the marketing funnel.

Collaborating with our client’s data science and business teams, we developed and engineered features for credit and risk models that would be used to drive their new loan product business. Our process for feature generation of customer transactions enabled the client to easily update, aggregate, and consume data in a repeatable and scalable way.

By developing a data-driven analytics capability that demonstrated effective customer targeting based on need and streamlined feature generation and data ingestion for model development, we enabled our client to progressively make smarter decisions about their customers and to launch their new business in lending.